| • | Let’s review our system logic. We’ve instructed Mechanica to reduce the number of contracts by 10% any time the position’s current risk is 20% greater than the position’s initial risk: |

Resize

~POSITION 'declare resize Category

'If current risk is 20% greater than initial risk then

'reduce position size by 10%

IF RISK > TRADEMEM[1] * 1.2 THEN MULTIPLIER = .9

| 19 | Click on the Parent account, and move the Calendar forward one trading day to Sep-18-2001. |

| 20 | Click the Process button to the left of the Parent account. |

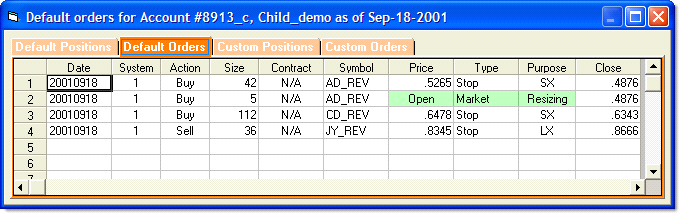

| • | After downloading and processing data for Sep-18-2001 we see that this Resize condition (code above) has become true. OM issues a Resize delta order (size adjustment) for the next trading day, Market on Open. |

Since the position is held short, Buying (“covering”) 5 contracts reduces the open position size by 10%.

| 21 | Click on the Parent account, move the Calendar forward one trading day to Sep-19-2001, and click Process (button to the left of the Parent account). |

| 22 | Click on Detail for the Child account. |

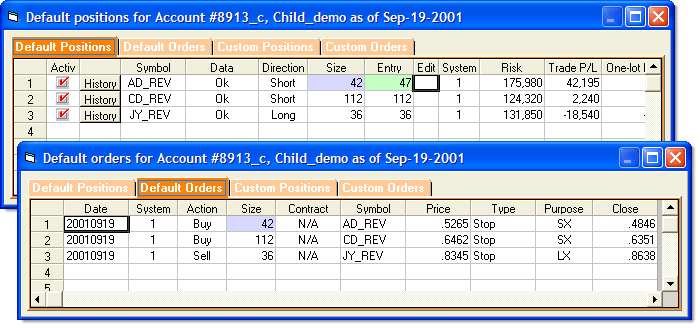

| • | Note that the Size of the AD position is reduced by five (5) contracts. In Default Positions, the original Entry size of 47 contracts is shown to the right of the current Size of 42 contracts. |

| • | Note also that the Default Orders tab has been updated to reflect the current Size of 42 contracts. |

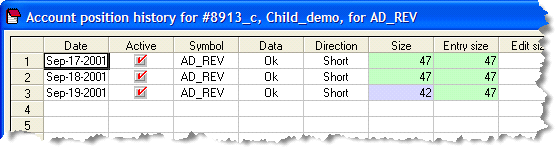

| • | This change is also recorded in the position history |

| 23 | Click the History button to the left of AD in the Default Positions grid |

Rescaling – to manage changes in account size

| 24 | This section discusses how to manage account additions and redemptions. |

| 25 | As the Child account fluctuates (via manual updates by the manager each day to reflect balance fluctuations in the actual account the Child represents), the position size of new orders generated is scaled, based on the ratio between the Parent and the Child account Trade Levels. Scaling of new trades occurs automatically for the Child, every time the Parent account is processed. |

| 26 | Order Manager will not generate delta orders for open positions though, unless the Child account is explicitly Rescaled to the parent. |

| 27 | Rescaling brings the size of open positions held by a Child account back into alignment with the theoretically perfect Parent account. |

| 28 | Due to your fund’s stellar one week performance, an investor has sent you an additional $5M to manage, thus doubling the current size of the Child account. |

| 29 | Here’s how to manage that event: |

| 30 | Click on the Parent account, and move the Calendar forward one trading day to Sep-20-2001. |

| 31 | Click the Process button to the left of the Parent account. |

|

|

| 35 | Click on the Parent account, and click Run Sizing Rules. |

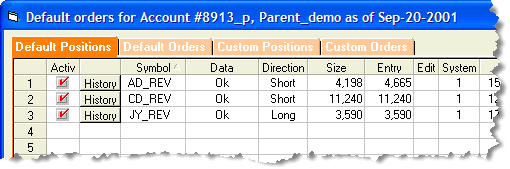

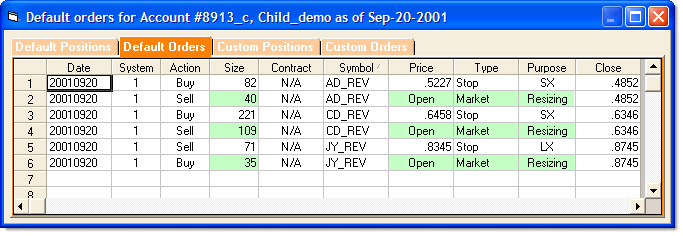

| • | Click on Detail, Default Orders (screen shown below). |

Note that delta Resize orders have been issued, approximately doubling the size of each open position.

But if the program was profitable over it’s life, and the Child account size doubled (and it did), then why didn’t the position sizes exactly double?

In essence, because while the Parent account has grown slightly (+1.83%), the Child account balance, or Trade Level, remained static until today’s Rescale event. Thus, the magnitude of the difference between the Parent and Child increased (the accounts diverged).

Let’s look at the Parent account’s balance and position sizes, and do the math for CD.

|

|

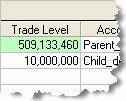

The Parent account’s Trade Level is $509,133,460, and it is holding short 11,240 contracts of CD. The Child account’s Trade Level is $10M.

How many contracts of CD should the Child account hold?

Simply set up the following proportion and solve:

![]()

Here, X = 220.7673, which rounds to 221.

Note that the short exit order (SX) shown two screen shots back is already adjusted to reflect the new size (221 contracts), and the delta Market on Open order of 109 contracts reflects the new size of 221 contracts minus the 112 contracts previously held in the Child account.

| • | Leave Rescale selected for the Child account, and let’s move on to the next trading day. |

Rescaling – to realign Parent and Child

| 36 | Click on the Parent account, move the Calendar forward one trading day to Sep-21-2001, and click the Process button (to the left of the Parent account). |

| 37 | Click on Detail for the Child account, and look at Default Orders. |

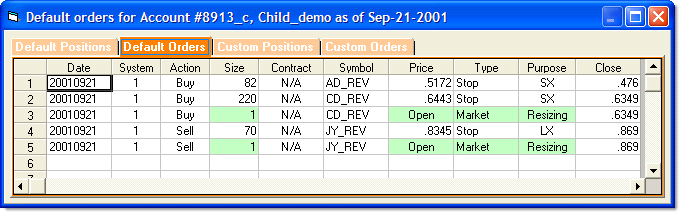

| • | Note that we now have two new delta Resize orders. |

As you can see, OM has generated delta Resize orders for CD and JY, to reduce each position by a single contract.

But...Why?

Because (a) the child account Trade Level is not being updated every day as it would be in actual trading, (b) Sep-21-2001 was an up day (the Parent grew from $509,133,460 to $510,190,295), so the Parent and Child accounts continue to diverge, and (c) Rescale was active for the Child account during processing. Thus, the delta Resize orders in CD and JY, which serve to bring the Child account back into alignment with the Parent.

Owing to the highly granular nature of futures contracts, even when a Child account is updated daily with the balance of the actual account it represents, a Parent and its Child account will grow at slightly different rates due to the difference in position size resolution (the position sizing resolution of the Parent is quite fine in this regard, and for all practical purposes is theoretically perfect, whereas by comparison, resolution in a Child account is coarse). When Parent and Child drift apart, and Rescaling brings the errant Child back into alignment with the theoretically perfect Parent.

Of course, Parent and Child divergence can also occur with stocks, particularly if you are trading round lots. But it is a pronounced phenomenon with futures.

|

When Rescaling is active (always on), it is not uncommon to see delta Resize orders such as these, even in the absence of redemptions, additions, or conditional Resize events. So if you turn Rescale on it will remain on until you turn it off. |

As mentioned in the first part of this document, frequency of rescaling is a matter of user preference and philosophy.

Some managers rescale Child accounts monthly or quarterly depending on the liquidity of their fund, and they may do so whether or not an addition or redemption was made, simply to bring the Child back into alignment with the Parent on a periodic basis.

Other managers rescale Child accounts daily, while some rescale only when a Child account experiences an addition or redemption.

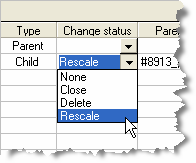

| 38 | Disable Rescale in the Child account by selecting None under the Change Status column. |

| 39 | Click on the Parent account, move the Calendar forward one trading day to Sep-24-2001, and click the Process button. |

| 40 | Repeat this process for each trading day until the data for Oct-02-2001 is processed. |

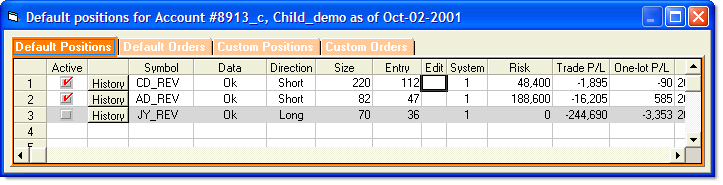

| 41 | Click on Detail for the Child account, and look at Default Positions. |

| • | Note the gray highlight across JY, the absence of a red check under the Active column, and Risk = 0. This alerts us that the LX stop was hit during the Oct-02-2001 session, and the position exited. |

| 42 | Click on the Default Orders tab, and you will see prospective entry (LE, SE) and contingent exit orders (LX, SX), for JY, to be entered on the morning of Oct-03-2001. |

| 43 | Continue to run the account forward day by day, through Oct-05-2001. |

| 44 | Click on Detail for the Child account, and you will see that Short exit stops (SX) were hit during the Oct-02-2001 session for CD and AD. |

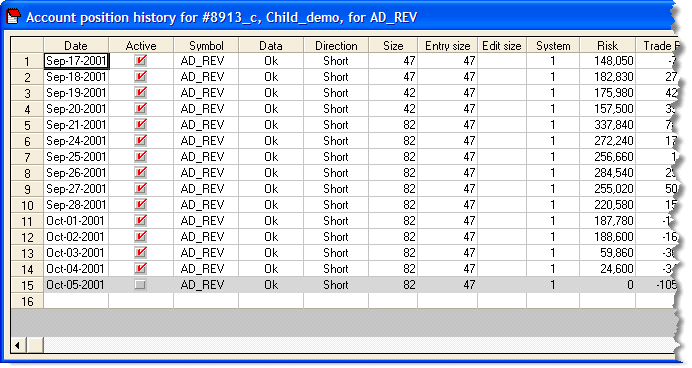

| 45 | Click on History for AD (shown below), and you will see a full record of all critical statistics for the life of this position. |

The portfolio is now flat, and this concludes the Tutorial for Order Manager. Please be sure to check out the FAQ.