The next demonstration employs a volatility band breakout system that enters on the open today, following a penetration of yesterday’s close. Again - for the sake of clarity, only a single JY trade is examined.

Parent account setup ($500M) began on October 18, 2004, and is completed on the following trading day – Oct 19 (creating orders for the 20th). Next, the Child account ($5M) is created and scaled to the Parent.

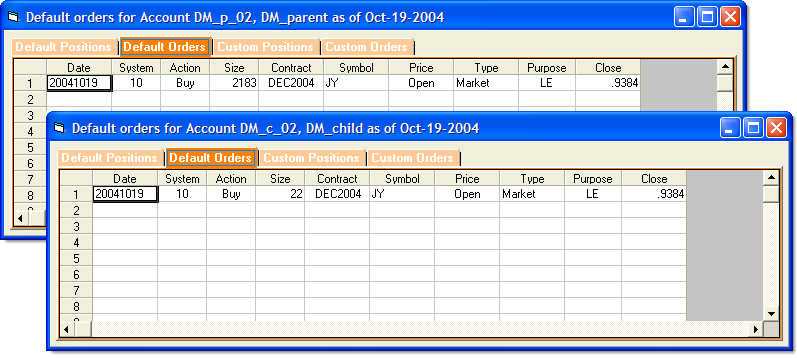

When the Default Orders tab is selected, we can see that a signal is received that same evening to be executed on the open of the 20th, and a Long Entry (LE) order is generated.

The only difference in the Parent and Child is the number of contracts; The theoretically perfect Parent indicates a size of 2,183 contracts, while the Child account (bottom window) – which has been scaled to the parent – indicates a position size of 22 contracts.

Changing the Child account size – Orders and Positions

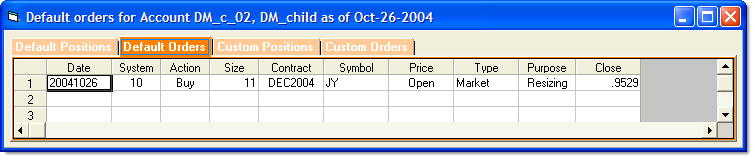

The system is run forward in time in Order Manager, day by day. Before the open on the morning of Oct 27, 2004, the allocation (Trade Level) of the Child account is increased from the original $5.0M to $7.5M, and the Child is rescaled to the Parent (in the primary OM screen, choose “rescale” from the drop down box under Change Status for the Child account. Select the Parent, then click the Run Sizing Rules button). Mechanica then generates the commensurate delta (size adjustment) order, shown below:

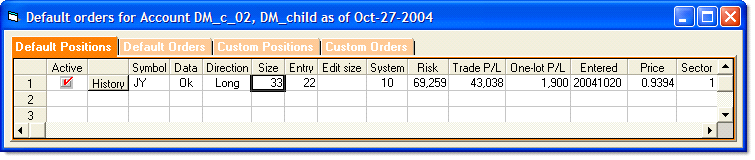

When the system is run forward to the next trading day, the Positions window for the Child account reflects this size adjustment, showing both the original position size at entry (22 contracts), and the 33 contracts currently held as a result of the increase in account value.

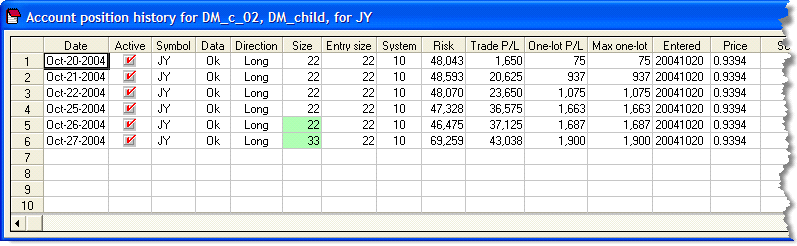

This size adjustment is also reflected in the Account position history for this position:

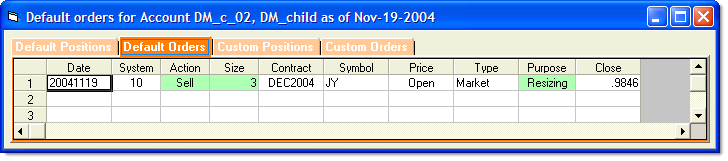

Again, moving forward in time to after the close on Nov 19, 2004 (but before the open of the next trading day), a Resize is triggered, based on the following code:

~POSITION 'initializes Category

IF RISK > INITIALRISK * 1.05 THEN MULTIPLIER = .9

Order Manager automatically generates the commensurate delta order for the next trading day:

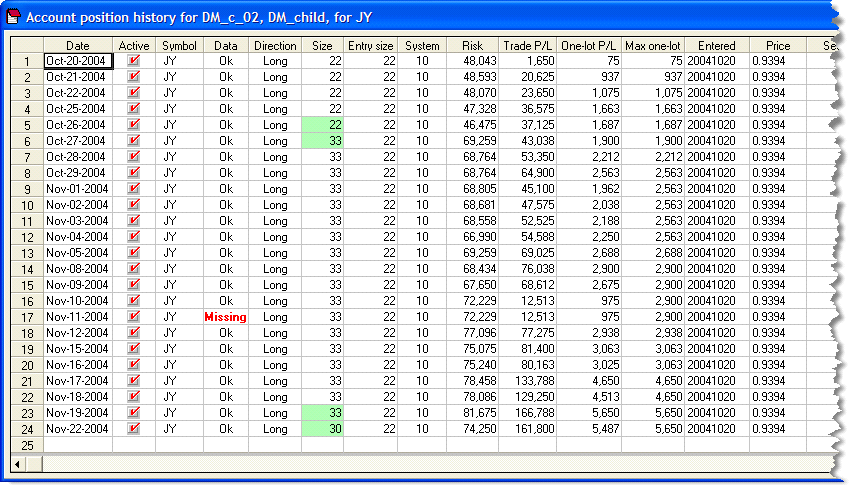

Data is downloaded after the close on Nov 22, OM is run for that day, and orders for the 23rd are generated. The Account position history window reflects the Resize adjustment, from 33 to 30 contracts:

Note the Missing alert in the Data column, on Nov 11, 2004. This was a US holiday (Veteran’s Day), and the financial markets were closed.

Mechanica internally organizes and tracks various Category and Category-related risk information utilized in Initial Sizing and Resize operations, independent of fluctuations in Child account size due to additions / withdrawals.

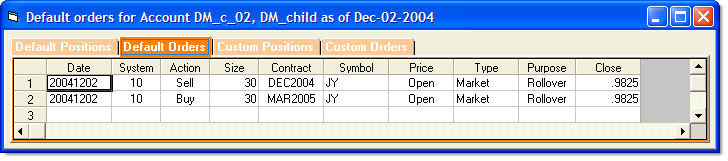

Order Manager also tracks contract delivery month information (if it is included in your data), and will issue roll orders, as shown below for our example JY trade: