Stepping into the equity curve

The two systems we’ve looked at thus far were combined into a single program that trades a diversified global portfolio of 50 futures markets. A small batch SIG file was created to run both systems and their associated SIZ file. A Parent account of $500M was created in Order Manager (the Parent references the batch file by name). A Child account of $5.0M was created, and associated with the Parent. Account setup was begun on Jan 03, 2005 and completed the next trading day, Jan 04, generating orders for Jan 05.

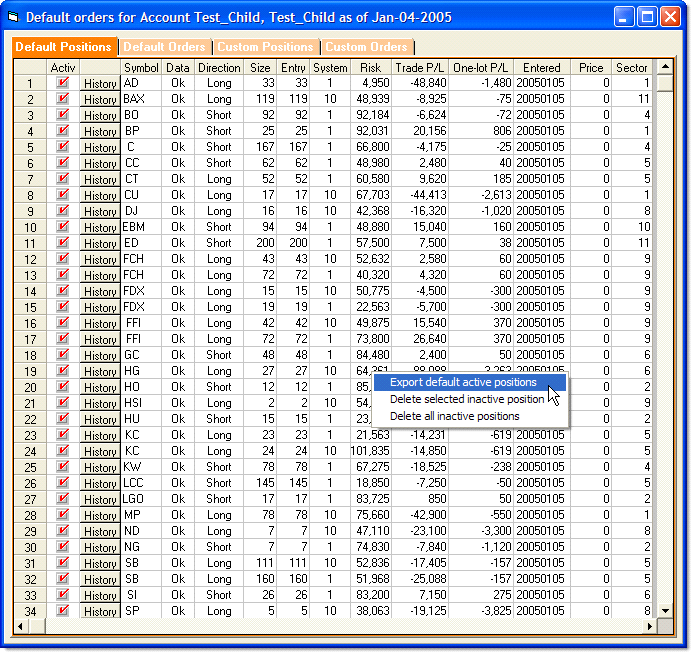

The first screen shot below shows all open positions as of the close of Jan 04 (for the trading day Jan 05), with their position size(s) after scaling to the theoretically perfect Parent, along with the number of the system that generated the trade, and other critical position data. When you begin trading a new account, you will need to tell your broker what your existing theoretical positions are, so that they can be entered, typically on the open of the initial trading day. This allows a seamless transition from the theoretical world, into live trading.

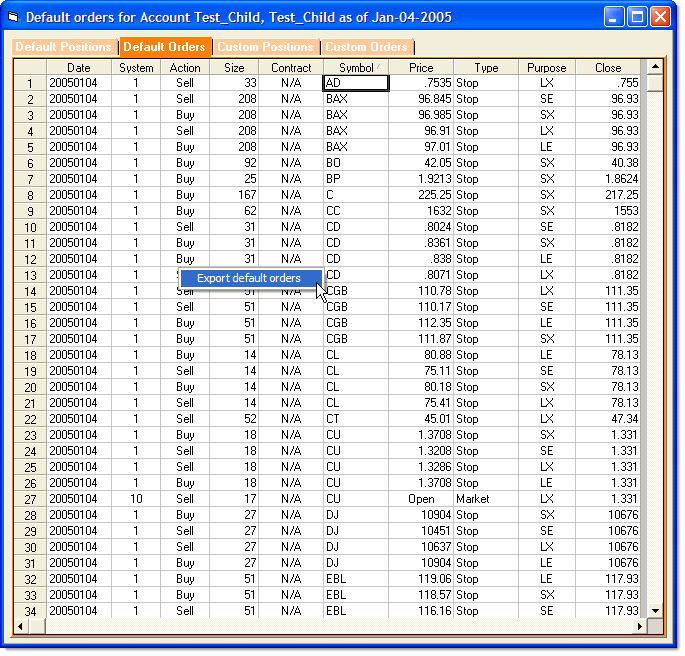

The second screen shows a partial list of the 134 prospective and contingent orders to be placed for the next trading day from both systems, along with their respective sizes and other critical data.

The data from both of these screens is easily exported to a *.csv file, with a right mouse click as shown below.