Mechanica’s Order Manager provides a comprehensive solution for automating and streamlining the often unwieldy tasks of order generation and position tracking in a systematic trading environment.

It provides for default order and position reporting, and a seamless transition from the theoretical world of historical testing into real-world trading. Please note the standard version does not include the right most two tabs beginning with "Custom", the graphics were made from the Pro version. The "Custom" tabs provide additional features in the Pro version.

Understanding the Parent / Child relationship

Order Manager can employ a Parent / Child account model.

This model answers the following question: If I had been trading this program for some time, what would my positions and position sizes be from yesterday, and what would my orders and their position sizes be for today, given different accounts of different sizes?

The Parent / Child model allows traders to step into a theoretical equity curve, and allows managers to do the same for their accounts, at any time.

A Parent account represents a unique trading program. A program may consist of one system trading one instrument, or multiple systems trading multiple portfolios, each with unique position sizing and resizing requirements, all run together under the domain of a single Parent.

But first, let’s back up and look at the basics of setting up a Parent account, and what goes on during the transition from backtesting to live trading.

The Parent account is created in Order Manager, and assigned a large starting account balance, or Trade Level. A large starting account balance results in a high level of precision in sizing positions, which is a critical factor given the granular nature of futures contracts and the subsequent disparity in the number of contracts traded among the constituent instruments in a diversified portfolio, given the same equity and risk per trade.,

Another way to think of it is that the Parent is so large that it takes all trades, and sizes all positions with significant resolution. Thus, we will occasionally refer to it as the theoretically perfect Parent.

In order to process all sizing and resizing tasks and generate current positions and orders for the initial trading day, two market days are required to set up a Parent.

Child account creation and scaling

When the Parent account setup is completed at the end of Day 2, a Child account can be created. Setup is complete after Mechanica scales the Child to the Parent. (The tutorial section for this topic leads you through the account setup process in more detail.)

During scaling, the Child consults the Parent for instructions.

The theoretically perfect Parent replies: Based on my current account balance and the position sizes I carry, and given the ratio of the differences in our account sizes, here is the number of contracts you should be carrying for your open positions, and here are your orders and their respective sizes for this morning.

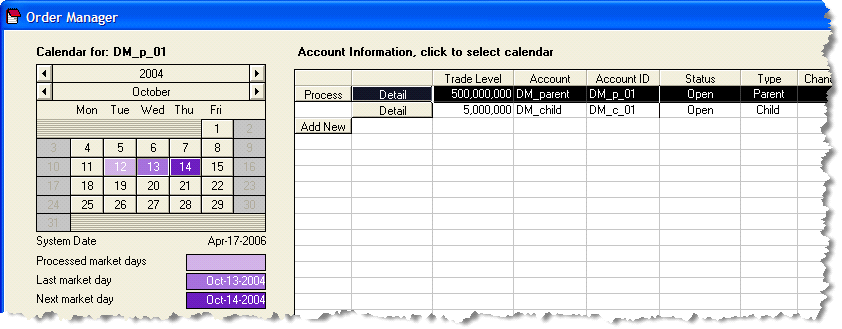

The example shown below uses the same starting account balances (Trade Level in Order Manager parlance), for the Parent and its Child that are used throughout the rest of this demonstration:

Scaling ratios position sizes in the Child account to those held in the larger Parent by setting up a simple proportion, and solving for the denominator.

Here’s an example that might occur for any instrument during a scale (or rescale operation), with the solution shown:

Acct: |

Parent |

Child |

Trade Level |

$500M |

$5M |

Contracts |

3,289 |

32.89 |

Given the assumption that the Round Size field for the Child is set to None (the default), the Child holds 32 contracts.

A Child account is always associated with a single Parent account, and their relationship is enduring; a Child account scales to the Parent account upon creation, and can be rescaled to the Parent many times, for various reasons, throughout the life of the relationship.

A Child account can be created at any time.

Rescaling a child account also minimizes equity divergence between a Child and its Parent.

Understanding the Childless Parent

Order Manager can employ a Childless Parent account model. Use the childless parent model only if you will never need to rescale existing position sizes. Typical reasons to rescale position sizes are to re-apportion them when a significant amount of money is added to or withdrawn from the account or to bring the account back into alignment with the it's own theoretical equity curve.

If you choose to use this model you should simply ignore the discussion about rescaling child accounts. However the other information about child accounts will apply to the childless parent so please follow that discussion.

Q. I’m an individual trader. Why bother with a Child account?

A. Once a Parent is set up, its job is to track the hypothetical results of the underlying program. So while the Parent's equity (Trade Level) fluctuates in response to hypothetical results, it should not be manually reset once trading begins.

On the other hand, a Child account can be updated with the actual equity figure each night, and rescaled to the Parent at any time.

One reason for rescaling might be to periodically pull the Child back into alignment with the theoretically perfect Parent. Another reason might be to adjust position sizes in response to a capital infusion or redemption.

Upon rescaling, Order Manager will issue delta orders (position size adjustment orders), for the next trading day.

Q. I’m a proprietary trader for an investment bank. The allocation to my program has changed. What now?

A. Simple. Update the Child account to reflect your new allocation, then rescale to the Parent. Order Manager will issue delta orders for the next trading day.

Q. I trade a pool. Why not just set up a Parent account, and go from there?

A. For the same reason that it behooves an individual trader to employ the Parent / Child model.

In this case (managing a pool), you would have a single Parent with one Child account.

When your pool experiences additions or redemptions, change the Trade Level of the Child, and rescale the Child to the Parent. Order Manager will issue delta orders for all open positions, and adjust the order sizes for the next trading day, in proportion to the change in size of the pool.

And you might choose to rescale periodically, if the Child gets too far out of alignment with the larger, theoretically perfect Parent.

Q. How often should I rescale?

A. Frequency of rescaling is a matter of user-preference.

Some managers rescale Child accounts monthly or quarterly depending on the liquidity of their fund, and they may do so whether or not an addition or redemption was made, simply to bring the Child back into alignment with the Parent on a periodic basis.

Other managers rescale Child accounts daily, while some rescale only when a Child account experiences an infusion or redemption.

A portion of Mechanica’s Order Manager primary screen is shown below. This is where all accounts are created, set up and managed.

As discussed in the previous section. Order Manager employs a Parent / Child account model.

The top account is the Parent, and its Trade Level is always set to a large value ($500M in this example), so that it sizes positions relatively free from the effects of contract granularity. In the examples that follow, the Child account, which scales to the theoretically perfect Parent, starts with a trade level of $5.0M.

Two trading days are required for account setup.

For demonstration purposes we will use an example where we know that a buy stop will be hit, in this case some time during the trading day of 20041014.

The first day of account setup takes place two trading days prior to this, on 20041012. (For the sake of clarity, only a single JY trade is examined.)

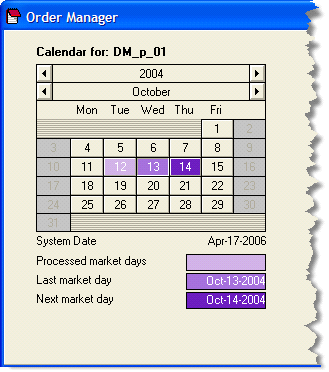

So on Oct 12, 2004, the first day of the Parent account setup is processed. The OM Calendar is moved forward one day, and processing is repeated for the trading day of Oct 13. The setup process for the Parent account is now complete.

The Child account is created next. It is associated with, and scaled to the desired Parent on that same date (Oct 13), and generates orders for this morning, Oct 14.

Note that Order Manager’s associated Calendar color-codes market days. In the screen shot to the right, it is clear that for the month of October 2004, we have already processed the 12th and the 13th (Last market day). We’re now ready to look at things from the perspective of a trader sitting at his desk prior to the market open on the morning of the 14th (Next market day). |

|

The next step is to examine the Default Orders Tab, which is accessed by pressing the Detail button to the left of the desired account (primary OM Screen).

(For the purposes of this demonstration, we know in advance that there is not a currently open position in the Yen.)