Position sizing is a strategic trading tool that can help you enhance the performance of your system by controlling risk.

This lesson and the one that follows are designed to convey the fundamentals you will need to develop position sizing strategies that maximize the performance of your systems and keep your portfolio’s risk-profile within tolerances that you define.

As mentioned in the introduction to this document, Trading Recipes broke new ground by giving traders the ability to conduct realistic multi-market simulations and apply an extensive library of position sizing and risk management rules to the systems they created. Mechanica expands these capabilities in every regard.

![]()

During the Initial Sizing phase, Mechanica allows you to accept or reject new trades, and determine the number of contracts or shares to put on, based on any combination of the following metrics:

| n | start up capital |

| n | closed, open and total equity |

| n | total drawdown |

| n | market volatility |

| n | actual market risk |

| n | the additional risk incurred if a position under consideration were executed |

| n | various categories of portfolio risk |

The position sizing logic in Mechanica is largely independent of the Signal Rules logic that we’ve covered thus far. This means that you can maintain separate Sizing files (*.siz) that contain only position sizing logic.

|

In Mechanica, there are two components to position sizing: Initial Size, and Resize. Their logic is stored in the same file (*.siz), and they are each processed any time the Position Sizing Rules are run. (Initial Size rules are always processed before the Resize rules, each day.) |

Once the Signal Rules are run and trades have been generated for a system (or for multiple systems, using Simultest), you are free to experiment with Initial Sizing and Resizing strategies, without having to re-run the Signal Rules each time.

For instance, if you develop five different position sizing strategies, and you want to test each of them against a particular system (called Breakout.sig, for example), you would first go to the Symbol Manager and tag all the symbols you want to test, close the Symbol Manager, and run the Signal Rules file Breakout.sig.

Then, open your first Position Sizing Rules file (SIZ file) and click the Run arrow icon (Position Sizing toolbar), to run the Position Sizing Rules. When the run is complete, Mechanica will display the Portfolio Performance window.

Now, simply open the SIZ file that contains your second position sizing strategy, and run the Position Sizing Rules again. Mechanica will take the trades generated by Breakout.sig when you first ran it, and apply the position sizing logic in the second SIZ file to those same trades.

As you can see, there is no need to re-tag symbols and rerun your system each time you want to test a position sizing strategy; just open the new SIZ file and rerun the Position Sizing Rules.

You can follow the same procedure for as many SIZ files as you want to test. Or, you can store all your position sizing strategies in one SIZ file, and comment out every strategy except the one you want to test.

You can just as easily develop unique position sizing strategies for each of your systems and incorporate them in a single SIZ file, then test them all together in Simultest mode, using the SYSTEM keyword to identify each system. (The value assigned to SYSTEM is used by the Position Sizing Rules to associate each trade with the system that generated it.) We’ll show you how to run Simultests in the next lesson (Lesson 06).

![]()

The two components of position sizing

To reiterate, there are two components to position sizing in Mechanica:

| • | Initial Size |

| • | Resize |

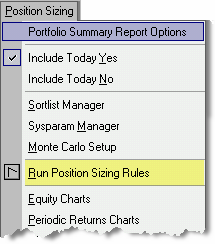

These two pages (tabs) are located on the Rules Editor. They are run any time the Position Sizing Rules are run. After running the Signal Rules, then Run Position Sizing Rules, under the Position Sizing menu.

The Position Sizing menu also contains options related to the Portfolio Summary Report—which is automatically displayed at the conclusion of each Position Sizing Rules run—as well as options related to the resizing of open trades.